Financial Aid For Part Time Study

Apply Here

Here you will find the application for aid @ Clinton Community College. Return this form (with prior prior year's NYS tax return ) to the Financial Aid Office at your earliest opportunity-as each institution is allotted a limited amount of funding. Awards are first come, first served.

You may print a copy of your NYS return directly by creating an account at: www.tax.ny.gov

Awards

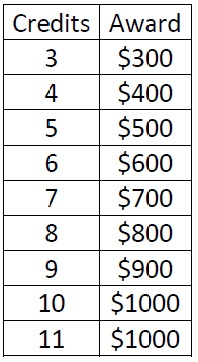

The Aid for Part-time Study (APTS) program provides grant assistance for eligible part-time students enrolled in approved undergraduate studies. Awards provide up to $2,000 per year for part-time undergraduate study at participating institutions in New York State. An APTS award cannot exceed tuition charges.

Eligibility

- Be a United States citizen or eligible noncitizen

- Be a legal resident of New York State

- Have graduated from a high school in the United States, earned a high school equivalency diploma by passing a Test Assessing Secondary Completion (TASC) formally known as a GED, or passed a federally approved "Ability to Benefit" test as defined by the Commissioner of the State Education Department

- Be enrolled as a part-time student

- Be matriculated in an approved program of study in a participating New York

- State postsecondary institution

- Be in good academic standing

- Be charged at least $100 tuition per year

- Not have exhausted Tuition Assistance Program (TAP) eligibility

- Not be in default on any Federal or State student loan or on any repayment of state awards

- Meet income eligibility limitations

Income Limits

Eligibility for an APTS award is based on New York State net taxable income, Federal, State or local pension income and private pension and annuity income, if applicable, from the preceding calendar year.

- For students who were eligible to be claimed as tax dependents by their parents, family New York State NET taxable income may not exceed $50,550. Family income includes student AND parent income.

- For students who were not eligible to be claimed by their parents as tax dependents, their New York State NET taxable income (including spouse's income) may not exceed $34,250. The spouse's income must be included if they were married on or before December 31 of the previous calendar year.

- For students who were not eligible to be claimed by their parents but were eligible to claim tax dependents other than self and/or spouse, their New York State NET taxable income (including spouse's income) may not exceed $50,550. The spouse's income must be included if they were married on or before December 31 of the previous calendar year.

Study Requirements

For this program, part-time study means being enrolled for at least:

- 3 but fewer than 12 semester hours per semester

- 4 but fewer than 8 credit hours per trimester

Selection

The New York State Higher Education Services Corporation (HESC) distributes APTS funds to participating colleges in New York State. College financial aid administrators select potential recipients from eligible students and decide who will receive APTS awards based on the funds they have available and students' needs. The Aid for Part-time Study (APTS) program provides grant assistance for eligible part-time students enrolled in approved undergraduate studies.